Leverage staking introduction

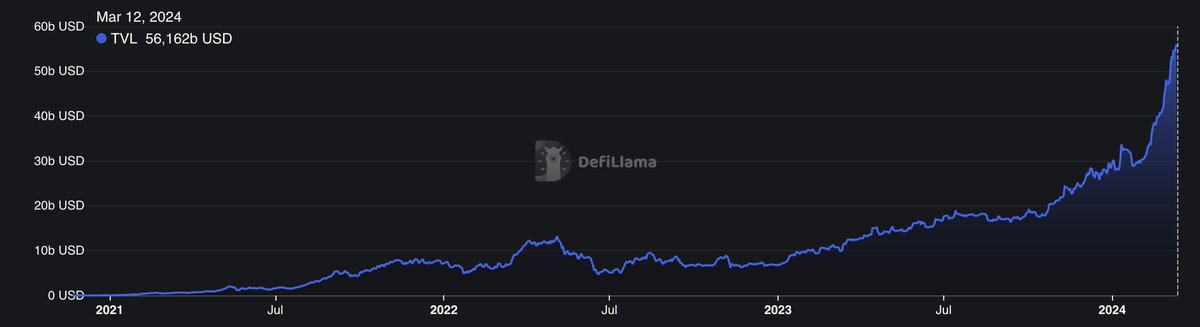

With a TVL of almost $60 Billion, liquid staking tokens (LSTs) have surged in popularity within the DeFi space.

The reasons for this surge are various:

🔹 Capital efficiency and Enhanced liquidity

🔹 Accessibility and Flexibility

🔹 DeFi Composability

The use of LSTs as collateral in DeFi has gained significant prominence. For the first time, users have access to a yield-bearing collateral which allows them to accumulate staking rewards while supplying these assets on Lending & Borrowing protocols.

A popular strategy to maximize returns is through LST looping, also known as Leverage Staking! ♾

Leverage Staking is a strategy to amplify staking yield earned from LSTs. First launched on Ethereum, this strategy is catching on among other PoS blockchains.

User can borrow an asset on a lending protocol, and use those funds to increase their staking position. This is achieved by borrowing against their initial deposit and resupplying it in the lending protocol, “looping” this tokens for higher yields.

Taking vDOT as example, here's how it works:

1️⃣ Users liquid stake $DOT with Bifrost for a X% APR and receive $vDOT

2️⃣ Users supply the received $vDOT to a lending protocol for an Y% APR

3️⃣ Using the supplied $vDOT as collateral, users borrow more $DOT at an interest rate of Z%

The borrowed DOTs are liquid staked on Bifrost and supplied again on the lending protocol as the loop continues.

Through this process, a user can stake more #DOT than those originally owned, earning enhanced staking yield on their initial position.

The multiplier increases as the vDOT/DOT loops increase, but users should note that looping also increases the risk of liquidation, which happens if the value of vDOT declines.

And you?

How do you see Leverage Staking on Polkadot? 👀