Bifrost SALP: Release Crowdloan Liquidity for Participants

Bifrost Slot Auction Liquidity Protocol (SALP), launched to release users’ KSM/DOT liquidity locked in Crowdloan by generating derivatives. SALP will greatly increase the capital utilization of crowdloan and attract more participants who do not want to lose opportunity costs to support the parachain slot auction. For users, SALP provides the opportunity to participate in crowdloan without DOT/KSM lock-up. For parachain projects, SALP increases the probability of successful bidding. In terms of Polkadot or Kusama ecosystem, SALP will increase the amount of slot auction bonding, allowing DOT/KSM to derive more creative functions.

Bifrost SALP will generate vsDOT/vsKSM and vsBond, two derivatives. Among them, vsDOT/vsKSM is a completely fungible token, while vsBond is not exactly for different parachains. For example, Parachain 1 and Parachain 2 will generate different vsBond-1 and vsBond-2. vsBond-1 itself is fungible, vsBond-2 itself is also fungible, but vsBond-1 and vsBond-2 are non-fungible. In addition to different parachains participate in the auction, vsBond will be different. The bidding behavior of the same parachain in different periods will also generate different vsBond, which will be explained in more detail later.

It seems a bit complicated, so why we design it like this?

Non-fungible factors such as different parachain lease period, different redemption periods, and inconsistent parachain reward strategies have led to the inability to achieve complete fungible of derivatives, and non-fungible is an obstacle to liquidity. In contrast, fungible derivatives will put liquidity together from different parachain crowdloans, forming an objective liquidity advantage. Therefore, Bifrost starts with the Token attributes in crowdloan, decouples its attributes to utility and equity, and designs two derivatives: vsToken (Voucher Slot Token) and vsBond (Voucher Slot Bond).

SALP Derivatives Workflow

The former is a fungible token, which represents a voucher of a user’s contribution to a parachain auction. The voucher can be traded at any time or cooperated with vsBond for 1-to-1 peg redemption.

The latter is a token represents the auction reward and lease period of different parachains, which smooths out the problem of different reward strategies between parachains. Meantime, vsBond can execute transactions through Bifrost’s built-in vsBond market, without having to consider liquidity issues.

Bifrost hopes to distinguish between a Token’s utility value and equity in the simplest way through vsToken and vsBond. At the same time, vsToken will have strong liquidity as a contribution derivative.

Technical Solution

Let’s discover the mechanisms of vsToken and vsBond:

vsBond: a token represents parachain auction reward and vsToken 1:1 redemption

vsBond represents the specific parachain and its successful Lease Period. Therefore, the full name of vsBond is: vsBond+Retirement Date+Kusama/Polkadot+Project Token symbol, for example: vsBond-2022–06–01-KSM-BNC.

vsBond has two main attributes:

-

Contribution Reward: vsBond can be transferred to the corresponding parachain through XCMP, and then only the address holding vsBond needs to be identified as a contributor.

-

Combined with vsBond, vsToken can be redeemed 1:1 after slots retirement. Therefore, vsBond can be regarded as a special product that contains Contribution Reward and 1:1 redemption. As an equity certificate, vsBond does not require high-liquidity transactions and can be sold through a buy-in-price form of pending orders in Bifrost vsBond market, without creating liquidity pools.

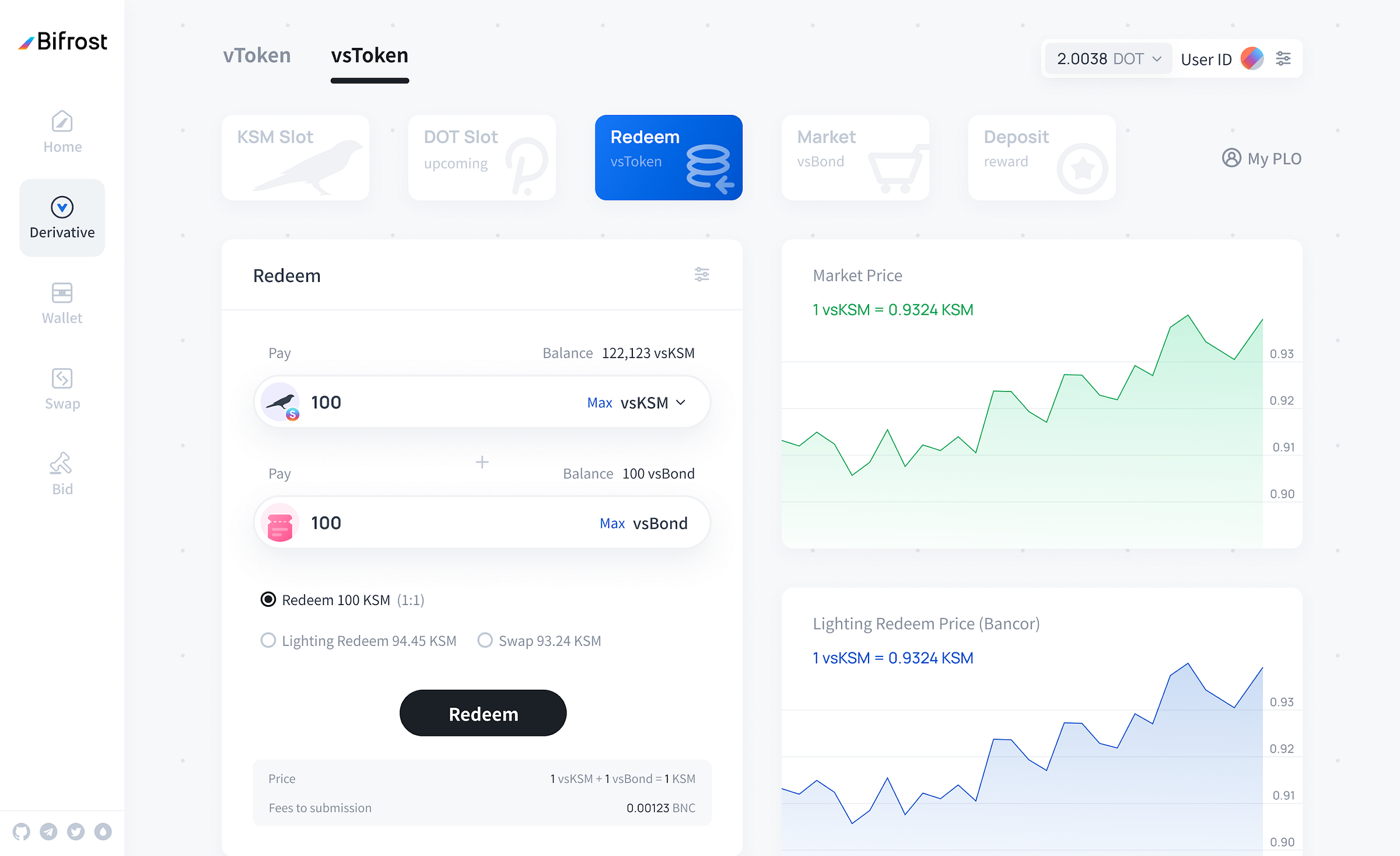

UI:vsBond+vsToken 1:1 redemption interface

UI:vsBond market

vsToken: a fungible token that releases contribution liquidity

The function of vsToken enables contributors to sell the vsToken in exchange for the original Token at any time, so as to achieve the purpose of releasing liquidity.

UI: Auction though SALP

Unlike vsBond, vsToken is not tied to specific parachains and Slots. To this end, Bifrost designed two exchange pools to achieve the fungible of vsToken: 1-to-1 peg pool and Bancor pool (1: x, x <= 1). The specific mechanism details can be checked at: https://wiki.bifrost.finance/learn/vtoken/salp

Potential Cooperation Projects

In the future, after Bifrost officially launches Parachain, SALP will be presented in a productized manner. Projects participating in the parachain slot auction can be configured with SALP to complete the creation of slot liquidity derivatives, and users can utlize Bifrost Dapp. SALP easily participates in the Parachain Crowdloan of the cooperative project. All votes will be automatically transferred to the Crowdloan address of the corresponding Parachain through the Bifrost SALP Module to participate in the auction. At present, SALP has also reached a potential cooperative relationship with a number of projects that require parachain auctions. In addition to trading and using DEX in Bifrost vTokenSwap and Polkadot/Kusama ecosystems, vsToken will also expand the liquidity scheme in centralized exchanges. With the launch of Bifrost’s parachain, the minting scale and liquidity of vsToken will be further gained to improve, the SALP program will also be open for use in other projects. For further communication, please contact salp@bifrost.finance.

Summary

The Bifrost SALP implementation plan is an innovative derivative product designed by the team after in-depth investigation of user needs and feasibility analysis and evaluation. In Polkadot, the multi-chain system architecture separates canonicity and validity, and establishes a bridge of mutual trust between differentiated consensus systems; Bifrost SALP has the same original intention as Polkadot, qualitative transaction attributes and differentiated equity attributes are divided into two, which promotes derivatives to obtain sufficient liquidity while lowering the barriers for users to participate. It is believed that SALP will be creative product in DeFi ecosystem when Polkadot slot auction is officially opened. SALP will also be applied for the first time in Bifrost’s upcoming Kusama parachain slot auction plan, stay tuned.

What is Bifrost?

Bifrost is the Polkadot Ecological DeFi basic protocol. It is committed to becoming an infrastructure for pledged assets to provide liquidity. Bifrost launched derivatives vToken for Staking and Polkadot Parachain Slot (Crowdloan). It has obtained $2.15M in fund-raising from NGC, SNZ, DFG, CMS and other institutions and Web3 Foundation Grant. It is also a member of Substrate Builders Program and Web3 Bootcamp.

vToken can optimize transactions in multiple scenarios such as DeFi, DApp, DEX, CEX, and realize the transfer channel of pledge rights such as staking and Crowdloan through vToken, realize the risk hedging of pledge assets, and expand scenarios such as vToken as collateral for lending, its staking reward part of the interest can be offset to achieve low-interest loans.

Join us!

Website | GitHub | Telegram | Medium | Twitter | Discord | SubSocial