Bifrost AMA Recap (Jul 8th)

Moderator’s Questions

Polkadot News Olga: Hi, Tyrone!

Tyrone: Hey everyone! I’m Tyrone from Bifrost, so exciting so see all of you here.

Question one: I’m sure some of you guys here may have heard about Bifrost through Youtube, Twitter, Medium channels, etc. Let’s start by asking Tyrone to give us a brief overview of Bifrost’s growth from 2020 to 2021 and what the focus will be in 2021.

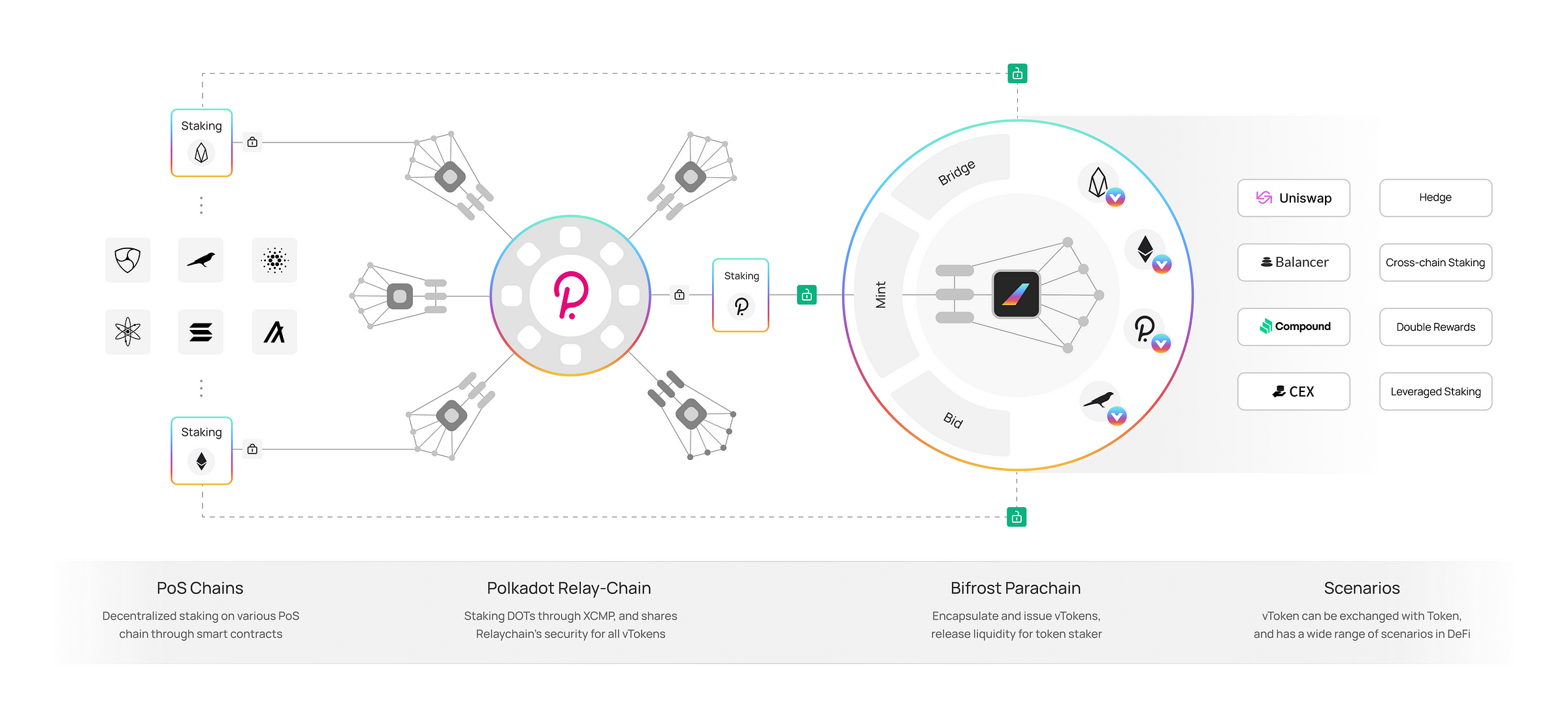

Tyrone: Bifrost is the Polkadot Ecological DeFi basic protocol. It is committed to becoming an infrastructure for pledged assets to provide liquidity. It has launched a derivative vToken for Staking and Polkadot Parachain Slot Auction (SALP). It has obtained $2.15M in fund-raising from NGC, SNZ, DFG, CMS and other institutions and Web3 Foundation Grant. It is also a member of Substrate Builders Program and Web3 Bootcamp.

After Bifrost completed the round of financing, Bifrost experienced rapid development, accumulating community, advancing products, in-depth cooperation partners, and a solid roadmap in a few months. It shows the growth and transformation that Bifrost has experienced, through hard work in 2020, Bifrost has now completed more than 80% of the basic function development.

In 2021 past two quarters, we went live our first product vETH (Ethereum 2.0 Staking liquidity) that Bifrost has successfully minted 18,000 vETH before the mainnet launch. The current market value of vETH has exceeded 45 million U.S. dollars. These will also be launched on Bifrost’s mainnet. Later, through Bifrost cross-chain to enter the parachain ecology.

In the 2nd quarter, we launched our Dapp beta v1.0, users can experience some basic functions about derivatives, more functions will be opened one after another. Something to look forward to is that we’ve complete the development of SALP modules, which include vsToken and vsBond mint, Swap, Bancor Pool, and integrated with Zenlink dex module.

Soon, after Bifrost board on the first batch of parachain slots, all participants can use the first liquidity product on Kusama ecosystem.

Polkadot News Olga: Wow, It seems to me that Bifrost made a huge piece of work from the days of beginning and till nowadays! Congratulations!

Question two: The most recent event in the Polkadot Ecosystem spotlight is the Kusama slot auction, so what made Bifrost decide to bid on the Kusama slot? And what are Bifrost’s goals for the auction?

Tyrone: An important reason why Bifrost chose Polkadot’s ecosystem is that it doesn’t need to maintain a set of consensus by ourselves. This is also an obvious advantage of being a parachain to connect with relay-chain, which enjoys the parachain shared security provided by all parachains. Maintaining a set of consensus security requires a lot of investment in capital and labor costs; It dosen’t make sense for a creative organization to quickly produce a killer application.

So, after we accumulated development experiences and researched about single-chain and multi-chain framework, we finally decided to develop Bifrost by Substrate, and becoming a parachain will enable us to accumulate the liquidity from different PoS chains to Polkadot layer-one, with shared security, but not only a smart contract.

At the same time, Bifrost can use smart contracts to deploy services on heterogeneous PoS chains outside Polkadot. For example, our Ethereum derivative vETH will become an ERC-20 and Substrate base dual-asset after bifrost mainnet on parachain is launched, and it will take much external value to Polkadot ecosystem beyond building bridges.

We will do our best to win the first batch of card slots as soon as possible and launch the mainnet. Keep following our new auction strategy.

Question three: And can you tell us about the latest Bifrost slot auction strategy? How should KSM holders who want to support Bifrost Crowdloan?

Bifrost Crowdloan has now entered the auction sprint stage. Double auction rewards are opened for all voting addresses.

The rewards have been increased from 1 KSM: 11+ BNC to 1 KSM: 22+ BNC, and the rewards have increased by up to 250%!

More info: https://app.subsocial.network/@Bifrost/bifrost-s-leading-reward-plan-adjusted-becoming-asgard-hero-18841

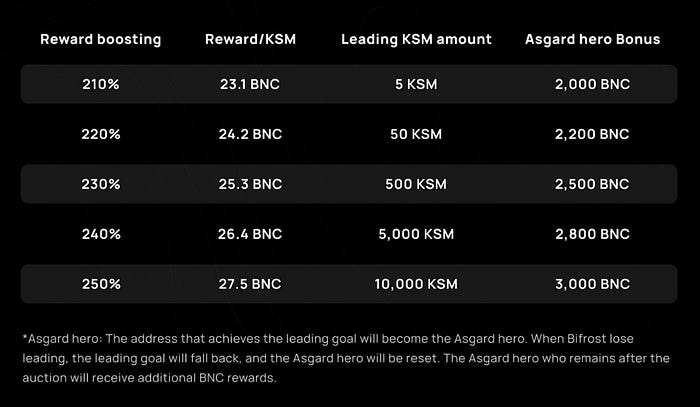

In order to secure the 4th Parachain slot, Bifrost needs to maintain a continuous lead. To this end, Bifrost has launched a gradient leading reward strategy, with rewards up to 250%. When Bifrost is the first candidate in the 4th Auction and is ahead of the second candidate by certain KSM amount, all contributors can receive additional bonuses.

There are five Gradient rewards can be activated if Bifrost is taking the lead! All participants can enjoy the boosting!

Simultaneously, the address that achieves the leading goal will become the Asgard hero. When Bifrost loses leading, the leading goal will fall back, and the Asgard hero will be reset. The Asgard hero who remains after the auction will receive additional BNC rewards.

More info: https://twitter.com/bifrost_finance/status/1412958898789621761

The hero airdrop is a very interesting reward mechanism, We’ll Catch up Phala as soon as possible, all pay attention to get those Hero rewards.

Thank you! Bifrost’s reward mechanism is really very interesting and should be considered as a profitable one.

Question four: Compared with other Kusama slot bidding projects, what are the bidding advantages of Bifrost and what rights can it provide users?

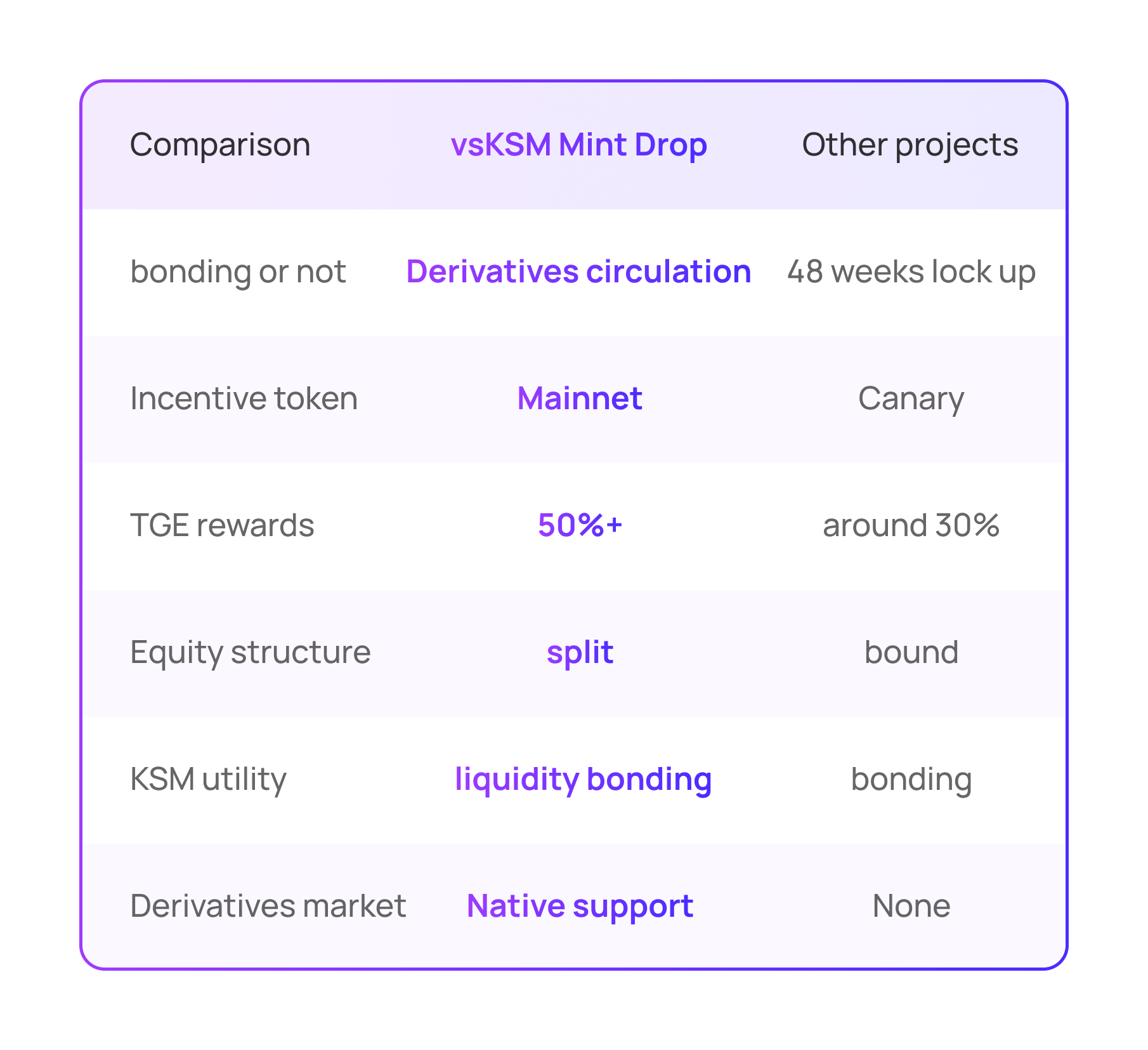

There are four obvious advantages that Bifrost auction has.

-

Mainnet bidding advantage: Bifrost, as the basic protocol for the DeFi derivative assets of Polkadot, will not issue a Canary network and run two sets of business logic, because doing so will cause the community to split and dilute the liquidity of derivatives. Therefore, the parachain strategy adopted by Bifrost is to run only one mainnet. When the Kusama slot expires, the data will be snapshotted to Polkadot’s genesis block to complete the migration of the mainnet from Kusama => Polkadot, and so our derivative (vToken) usage scenarios have been fully upgraded. Due to the strong binding relationship between the value of BNC and the liquidity of vToken, under the impetus of a complete economic model, the value of BNC will steadily advance with the business development of the main network.

-

Release KSM lock-up liquidity: Bifrost’s unique slot auction liquidity protocol SALP will support Bifrost slot auction for the first time in Kusama auctions. All KSM pledged through ksm.vtoken.io will receive liquidity derivatives vsKSM+vsBond. The former is used to release liquidity, and the latter is used to receive parachain rewards.

-

SALP derivatives are rich in usage scenarios: firstly, vsKSM as the basic function of the derivative token will create the liquidity release of vsKSM/KSM, and secondly, vsBond as a semi-homogeneous token will create a parachain reward trading market. In addition to being used to redeem the native KSM, vsKSM+vsBond’s innovative economy mode will be able to obtain rewards from Bifrost and other parachains in the form of pledge mining.

-

The 50% reward will be released immediately and the transfer will be initiated: Bifrost will initiate the Token Generation Election proposal after the parachain is launched. Once the proposal is passed, all mainnet BNC vouchers will be converted to native tokens and the transfer will be initiated. 50% of the parachain auction rewards will be released immediately, and the remaining part will be released linearly within 48 weeks.

Participating in the Bifrost crowdloan has generous rewards and bonding with KSM liquidity. Compared with airdrop activities of other projects, it has a great advantage.

Question five: What are the follow-up plans for Bifrost if the slot is bidded, and how will it cooperate with projects in the Polkadot ecosystem? If the first batch is not bidded, what is the next plan?

At this stage, Bifrost has basically completed the development of the SALP and SWAP modules, is testing it on the Bifrost Asgard CC4 network(https://apps.bifrost.finance & https://dash.bifrost.finance), and will enter the audit process soon.

This means that after Bifrost wins the parachain, it will first unlock the usability of SALP liquidity derivatives at the product level, so that the first batch of users who participate in the auction through Bifrost’s official auction have the opportunity to use the Bifrost embedded Bancor pool to experience the first flow on Kusama Sexual release.

Subsequently, the opening of the SWAP module will initiate the one-stop liquidity mining and exchange of derivatives of $vsKSM and $vsBond. If Bifrost successfully bid for the 4 slot of Kusama, this feature is expected to be completed in August-September.

In the next six months, the Staking Derivatives Protocol SLP will be deployed in Kusama, and the business will be migrated to the Polkadot mainnet based on the Polkadot bidding situation and the Polkadot <=> Kusama cross-chain bridge situation.

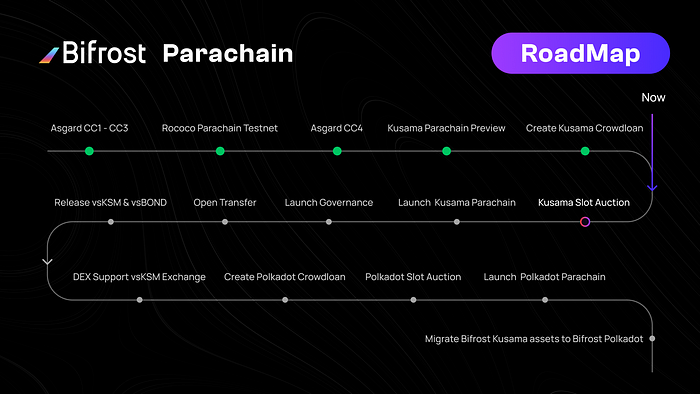

Bifrost Parachain RoadMap

This is Bifrost parachain launch roadmap. It is worth mentioning that Bifrost has successfully minted 18,000 vETH before the mainnet launch. The current market value of vETH has exceeded 45 million U.S. dollars. These will also be launched on Bifrost’s mainnet. Later, through Bifrost cross-chain to enter the parachain ecology.

Question six: We all know that Bifrost will provide liquidity to parachain locked assets, how will Bifrost guarantee the safety of the funds? How can Bifrost guarantee liquidity in case of continuous selling pressure?

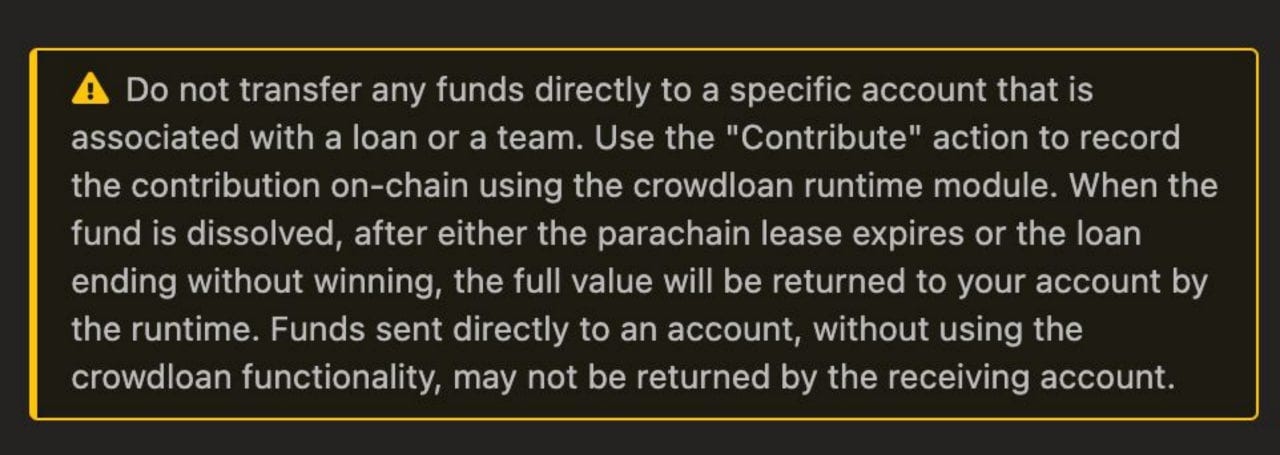

Good question, some users asked us: About other projects, when contribute outside from polkdot.js (on project website) the contribution amout also shows in polkadot.js as well, but not with bifrost, other project website is using the ‘crowdloan runtime module’

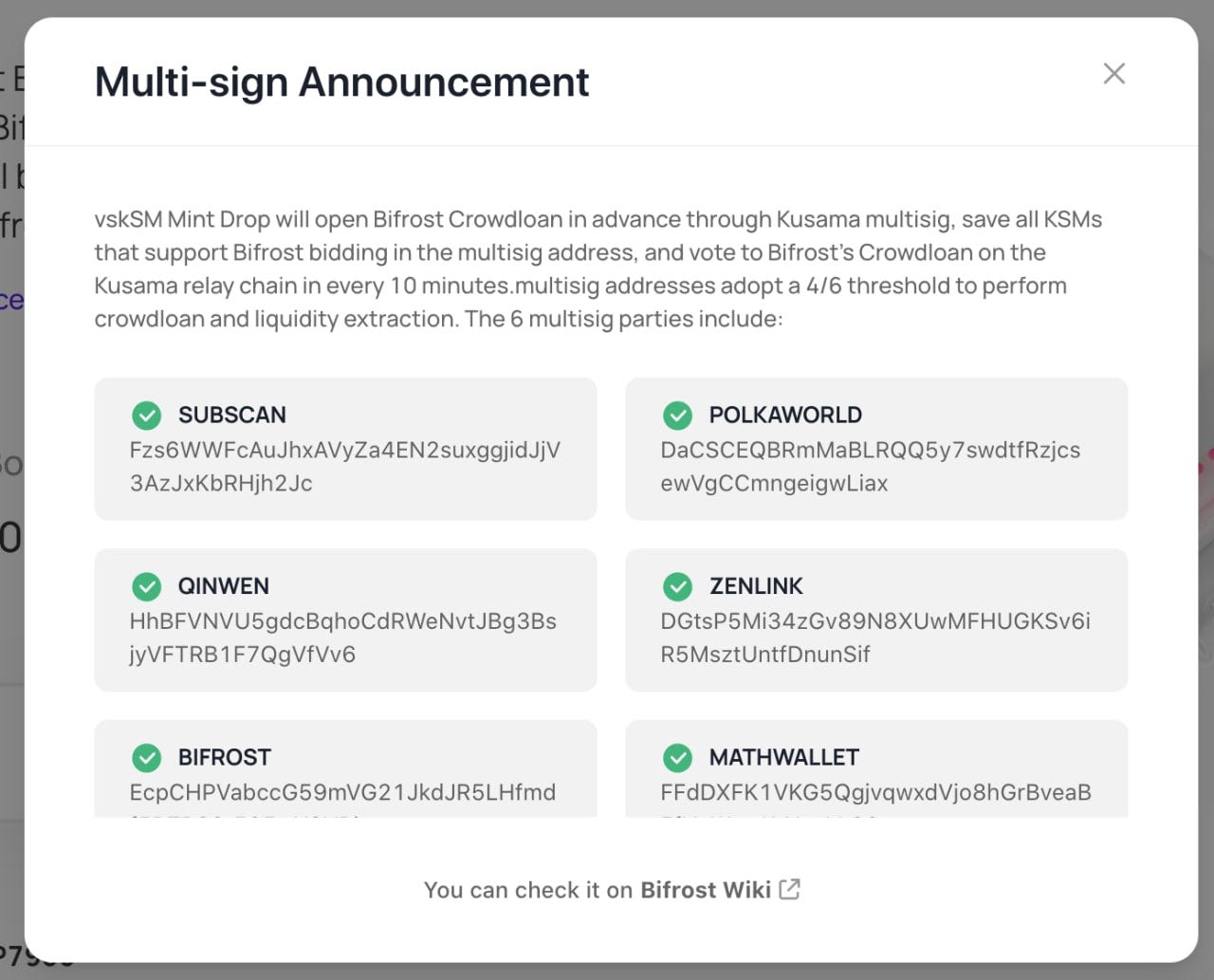

The reason why you can’t see it on polkadot.js, is that Bifrost is using Kusama multisig account contribute to polkadot.js. So, all contributions from vsksm mintdrop page will be accumulated in a multisig account, which managed by 6 parties, so all operation calls need to be executed through multisig threshold. And there is a contribute Proxy account, it delegates Crowdloan Multisig account. The system has automatically closed the transfer, and the proxy account can only perform Contribute operation.

Therefore, you can’t see it on polkadot.js, because your contribution was delegated by Bifrost multisig account.

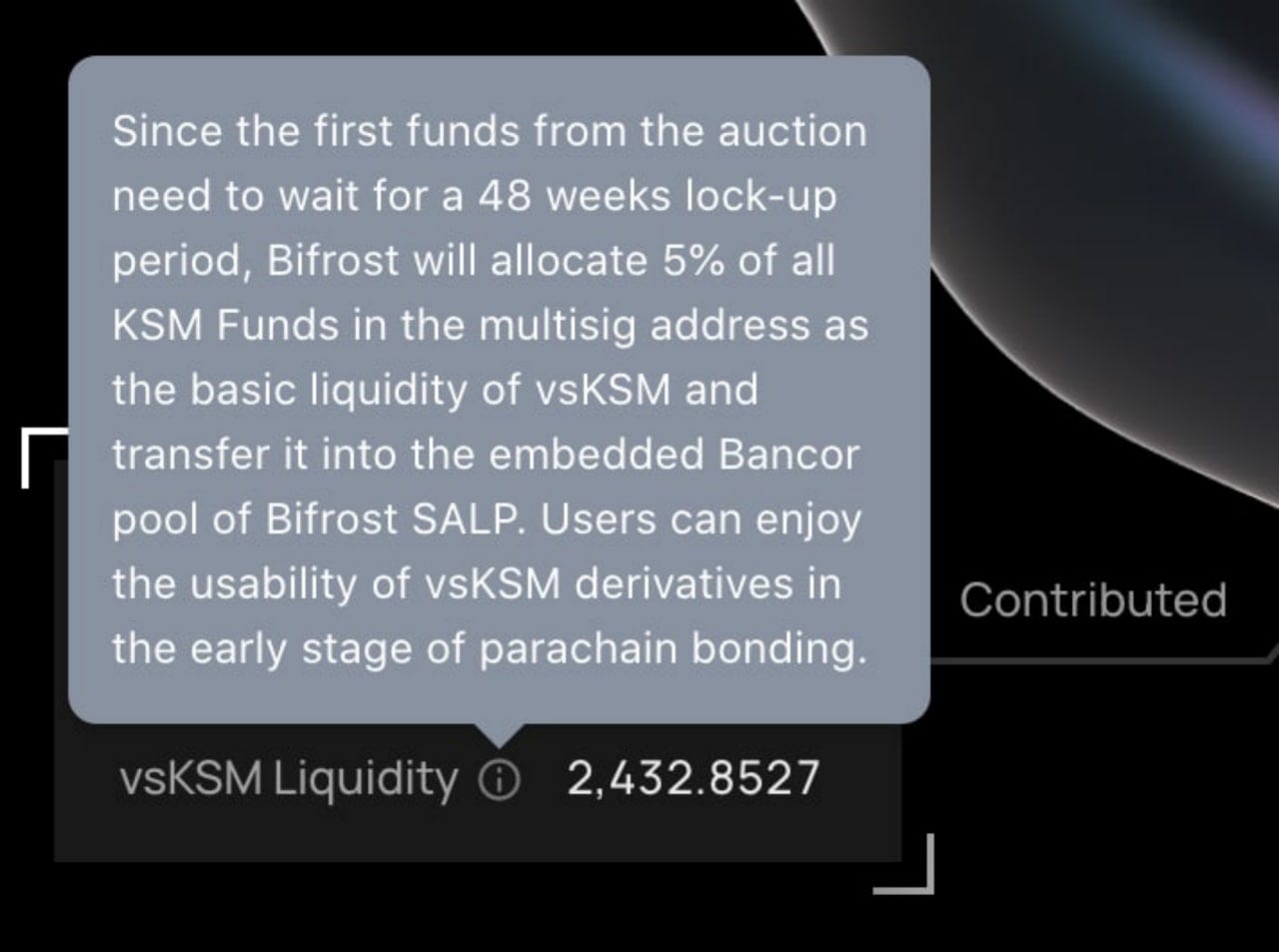

If you take a look here on ksm.vtoken.io, you can find the multisig account actually not contribute all KSM to the polkadot.js, because Bifrost will keep a part of bonding liquidity when parachain works, so contributors who contributed from vsksm mintdrop page will have chance to swap some vsksm to ksm.

You may find this on Polkadot.js

We have to say, the multisig account is not totally trustless as polkadot runtime module, our team want to provide auction bonding liquidity before we are not a parachain yet, so we can’t use module to issue derivatives and keep a part of initial liquidity as a parachain yet. It will be definately achieved when Bifrost wins the parachain.

https://wiki.bifrost.finance/publicity/crowdloan-multi-signer you can check how it works here. And all multisig parties can be easily checked on-chain, include some famous polkadot projects.

BTW, very good question, trust and safty can not be ignored.

Polkadot News Olga: Thank you so much for your answers, Tyrone. I’m done with my questions and I think we are ready to the questions from the community!

Tyrone: ok, let’s go for answers.

Audience Questions

Q1: What makes Bifrost different from other blockchain projects? Does Bifrost any advantages to compete with previous strong development and community projects?

Some projects provide staking liquidity but Bifrost has more advantage by using XCMP on Polkadot parachain to achieve the interoperability by using vToken, but not only smart contract. Smart contract will just only focus on specific chain, which will disperse the liquidity of derivatives, but Bifrost as a Polkadot parachain will provide general type derivatives across different parachains without splitting the liquidity. Bifrost will provide staking liquidity for more PoS blockchains by smart contract in the future (if they haven’t connect with Polkadot). Meanwhile, the mechanism of Bifrost staking reward distribution will eliminate the problems of cross-chain harvest.

Q2:How can NFTs be incorporated into Bifrost?

RMRK is our in-depth partner. In the future, we will build vsBOND into an NFT, which will bring more value and fun to the parachain and slot auctions. If Crowdloan supports Bifrost for more than 10 KSM, you can also get one of RMRK Kanaria Bird’s rare piece of equipment, please see here for more details: https://bifrost-finance.medium.com/2326b3b314c5

Q3:Does your project support staking program?if yes. how is your stake system work, what is the requirement for user if they want to stake in your platform?

Yes, Bifrost is also a Layer 1 network, which will support WASM smart contracts in the future, but our logic is that if a network does not have users and assets, it will be difficult for developers to contribute high-quality applications in the ecosystem. Therefore, Bifrost will first attract a large number of users and assets through the SLP and SALP, and then provide a WASM environment for developers to deploy smart contracts.

Q4: All projects are geared towards the development of the community, because the community is the key to the strong development of the project. So do you have a Global Ambassador Program or Referral Rewards System or bonuses for newcomers to your community?

Check https://wiki.bifrost.finance/publicity/contribute and post your information to our administrators.

Q5: A question about Bifrost token, adoption of token to the ecosystem is one of the good things to increase its usability and spend, so what role does Bifrost token play to the ecosystem?

-

Liquidity commission for derivatives

-

Slash collateral

-

Governance Voucher

-

Capture of Staking Reward

All routine will cost BNC in Bifrost ecology. Thanks all. Amazing questions. Don’t forget to support Bifrost at https://ksm.vtoken.io.

Learn more about Bifrost

Website | GitHub | Telegram | Medium | Twitter | Discord | SubSocial